Corn, wheat and soybeans all experienced a considerable move higher today, with corn trading limit up, as the USDA reported much lower inventories than expected. The USDA is saying several grains saw a record drop in yields. For quite some time, I have been concerned that a lack of investment in the Ag space could lead to stress in the supply for foodstuffs. Unfortunately, this lack of supply could lead to much higher prices. All the grains are up considerably in the past six months with corn, beans, and wheat appreciating 67%, 73% and 41%, respectively, above their 52-week lows.

For the first time since 2011, grain prices are now trading in backwardation, as they almost always did before 2011. Backwardation means the speculators (read: Wall Street banks, hedge funds and large trading institutions) are liquidating their net short positions and either abandoning the space or going long. Some of these players who hold their short positions for too long may take a considerable hit if there are physical shortages as the USDA suggests may happen. (A more conspiracy-minded friend of mine suggested that the impetus for Trump's trade war with China was a direct attempt to try to get them to stop buying our soybeans and other foodstuffs b/c our government knows that we are facing shortages. I'm not so sure if anyone in Washington is that clever but it is interesting food for thought.)

We have considerable exposure to the Ag space and while we think it is wise to have exposure, we know there are considerable pitfalls for retail investors in this space.

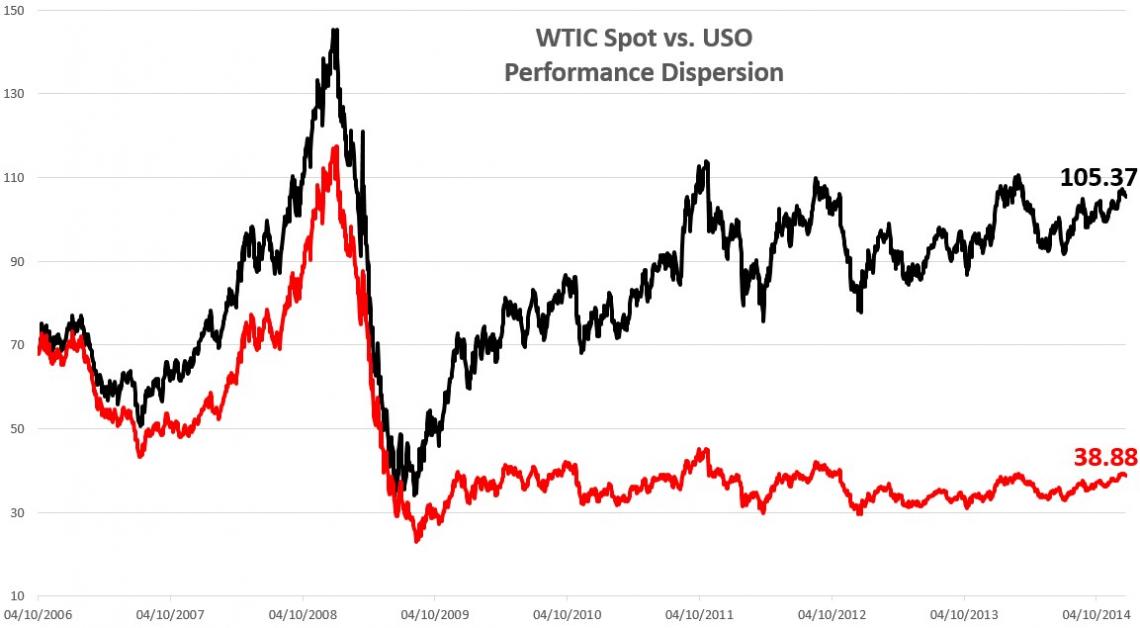

Pitfall #1: Assuming your commodity fund actually tracks the price of the underlying commodity. For those who may be unfamiliar with the history of commodity funds, most have done a horrific job of tracking the price of the underlying commodity. Funds like USO (United States Oil) and DBA (Invesco DB Agriculture Fund) have underperformed the physical commodity by an egregious amount. The funds have done reverse splits or changed their indexes or both in an attempt to hide their miserable performance. I know at one point, USO had underperformed the price of oil by 75%. DBA has changed the index it tracks so many times it is impossible to say to what degree they have underperformed. Here is a chart of USO's underperformance that I created back in 2014. I haven't bothered updating it because the redline would be in the dirt by now.

Pitfall #2: Buying and Holding commodity funds. Commodities behave very differently than stocks. A good stock can be bought and held for one's entire lifetime and provide returns many multiples of any specific index. Stocks tend to go up far more often than they go down. Most folks have heard various statistics that start with, "by missing out on the 10 best days, a stock investor would miss.....". This is not the case with commodities that spend most of the time either going down or sideways. They only go up when they have to. But when they go up, they go up a lot. And the reason they go up a lot is that there is often a shortage. It is our position that commodities are not be bought and held but rather traded according to their momentum. The only time one should be buying commodities is when they are going up with positive momentum.

Our solution to these pitfalls is multi-faceted. First, we conduct extensive due diligence to best ensure our clients are getting the most accurate exposure to the commodity space possible. We have varied types of exposure to the commodity space. We do own futures for some of our grand-fathered clients but for the most part, we own either RJA (Rogers Int'l Commodity Index) and we use the Teucrium funds (CANE, CORN, SOYB & WEAT). These funds seem to be tracking the price of the underlying commodity futures as well as any I've seen.

Second, we apply our proprietary algorithm to uncover low-risk entry points and trailing stops to lock-in profits. In the dislocated commodity space where various commodities may appreciate where others are flat or depreciating, we find a mathematical approach to investing in various commodities helps us establish the best exposure.