There is considerable chatter about inflation coming home to roost over the next several months to years. And we have addressed the inevitabilty of price inflation for some time on this site. When the media talks inflation, what they are talking about specifically is price inflation - the kind of inflation that hurts. Prior to price inflation, there is always monetary inflation. Monetary inflation is simply expanding the supply of money beyond the growth of the economy. The old saying goes, "Price inflation is simply more money chasing fewer goods". Price inflation always lags monetary inflation but the two are invariably connected at the hip.

Monetary inflation has existed in spades for the past decade, accerlerating with QE in November of 2010. And of course, it went hyperpolic last year when the FED exploded the money supply. For every $4 the FED created from 1918 through 2019, the FED created an additional $1 in the span of just a couple of months in early 2020. To paraphrase the parody movie Spaceballs, "The FED's monetary policy went plaid in 2020."

So if there has been copious amounts of monetary inflation, why haven't we experienced any price inflation, or at least any meaningful price inflation. Well, there are a host of reasons.

- First, we have exported massive amounts of inflation over the past two decades. If you look at the growth of economies of China and other emerging markets, it is quite obvious their standard of living has increased multi-fold while the average US citizen has seen their standard of living stagnate the past 20 years. This is at least partially due to exported inflation. More expansive goods made in the US have been replaced with cheaper goods from overseas but that trend is approaching its asymptope.

- Second, a massive amount of monetary inflation has been directed directly into the capital markets and real estate pushing the prices for "investments" higher thus avoiding a boost in the price of consumable goods. When the FED prints money out of nowhere, the first recipients are the FED-member banks (of which, Wall Street represents a significant share). These banks have a choice as to what to do with the funds. They can loan the money out to consumers or they can put it to work in the capital markets. When QE first started, they did both and there was a parabolic spike in the price of consumable goods. I assume at some point, the FED member banks colluded to direct the majority of FED created funds directly into capital markets and thus keep price inflation tapped down. (This may sound like a large undertaking but when we consider that well over half of the FED is owned by the NY FED which is owned by just a handful of large Wall Street banks, collusion becomes far more manageable.)

- Third, the actual rate of price inflation tends to be much higher than the official calculation the federal government prints, called the Consumer Price Index. Many years ago, I wrote a post explaining how our government consistently underprices inflation using the CPI. You can read the post by clicking here: "The CPI Lie". (Spoiler alert - one of their main tools is "owner's equivalent rent" which uses the price of average rent rather the price of an average home - so as they inflate home prices and more people buy homes which become less affordable, rents actually decrease thus lowering CPI, not raising it!)

I believe there are other reasons, some nefarious and some legitamate, as to why price inflation has lagged monetary inflation. But those would take considerable time to divulge.

The bigger issue is how do we hedge or invest in inflation. I have sat through countless workshops/seminars/ect. where various "experts" insist that stocks are the best inflation hedge. And this is pure, utter non-sense. If we examine periods of high inflation, the early 1900's, the late 30's into the 1940's and the 1970's, we can quickly determine that above average price inflation leads to below average stock returns - and negative bond returns.

The data supports the simple and common sensical notion that the best way to hedge price inflation is to buy things that lead to price inflation - which most often is commodities (yes, labor costs contribute to inflation as well but I don't know how to invest in labor costs) .

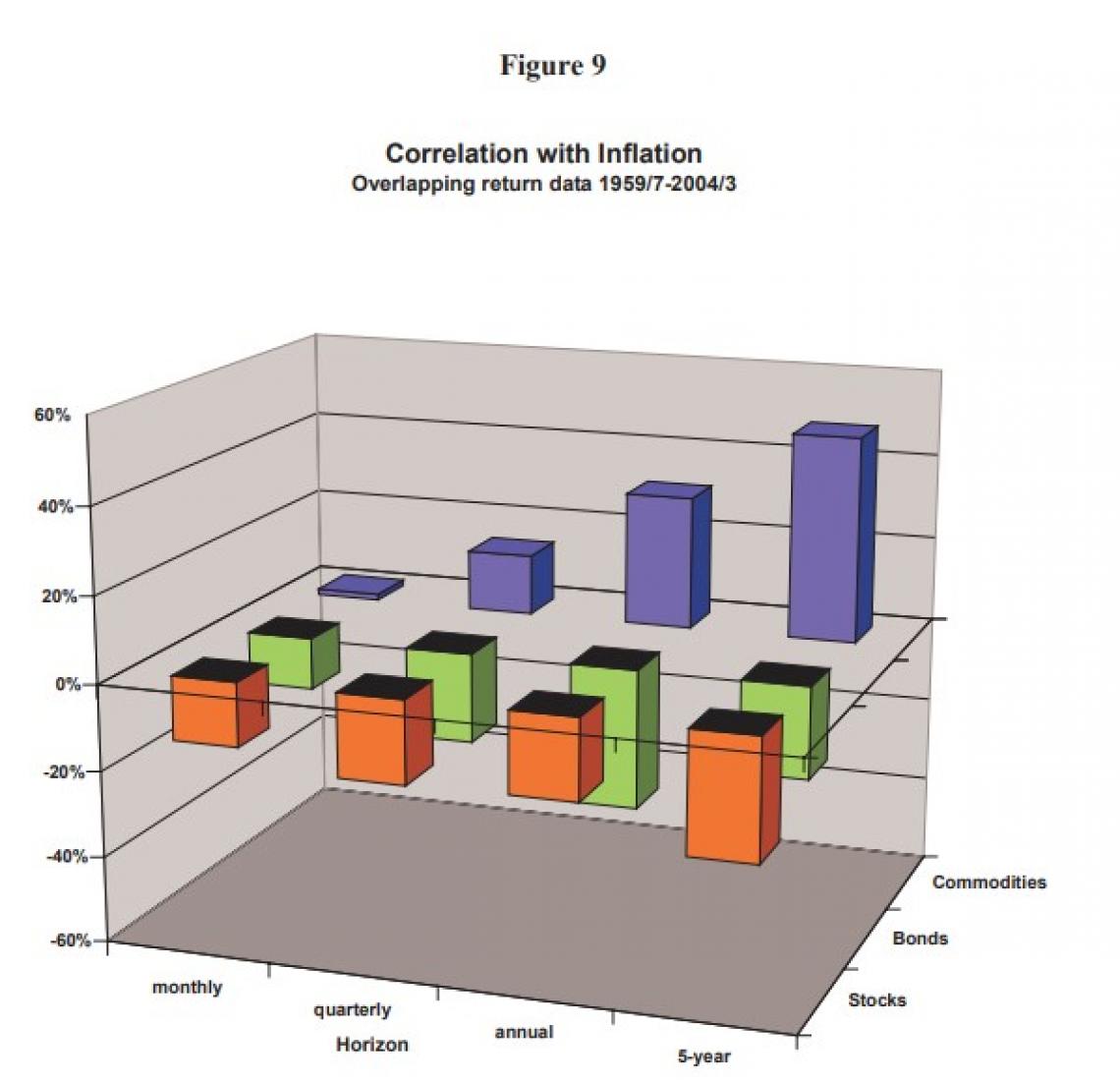

Several years ago, two economists from the Yale University International Center for Finance wrote a whitepaper called "Facts and Fantasies about Commodity Futures.". I can't find the paper online anymore so as to provide you a link but if you fill out the contact us form on this page, I'll e-mail you a copy. The paper makes a clear cut case that commodity futures have always been the best hedge for "unexpected inflation" or inflation in excess of the historical average. The following is a graphic which illustrates this proof.

In the paper, the authors write the following:

1. Commodity futures have an opposite exposure to inflation compared to Stocks and Bonds. Stocks and Bonds are negatively correlated with inflation, while the correlation of Commodity Futures with inflation is positive at all horizons.

2. In absolute magnitude, inflation correlations tend to increase with the holding period. The negative inflation correlation of Stocks and Bonds and the positive inflation correlation of Commodity Futures are larger at return intervals of 1 and 5 years than at the monthly or quarterly frequence.

So there you have it. Stocks and Bonds perform poorly when inflation is above average and Commodity Futures perform above average!

Commodity investing can be daunting as there is less information and more misinformation about Commodity Futures then say Stocks or even Bonds. But the learning curve while steep can be conquered. If you need a guide, certainly reach out to us.