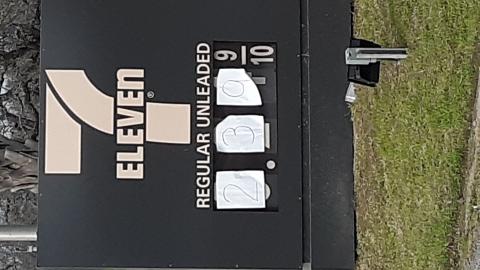

The above picture is one I took personally from our local gas station right in Horseshoe Bay. Since I took this picture a couple of weeks ago, the price of a gallon of gas has already risen 20c. I have no idea why the picture appears sideways but I think my readers understand the significance of it.

Disclosure: Our firm's clients have exposure to various inflation plays Specifically, we own TIP, SGOL, CEF, FNV, U.to, UEC, RSI.to, ZS (Soybean futures), and RJA. Furthermore, some of my client accounts are approved to own foreign currency positions and some of their cash is parked in Swiss Francs, Canadian dollars, and Russian rubles.

The inevitability of inflation is becoming more widely accepted since the FED and the US Congress have agreed to go on a money-printing binge unlike any other in our nation's history. For every $5 that the FED created in the prior 100 years, they created at least an additional $1 in the past 12 months (the FED is not audited so we just have to take their word for it but if they are admitting to this much stimulus than I think we can safely assume its even greater than they are advertising.) The sheer magnitude of their response to the Covid pandemic is purely asine.

Consequently, investors are becoming justifiably concerned about how to hedge [price] inflation. (I put "price" in brackets because often when we refer to "inflation" we are really referring to "price inflation". Technically, there are two types of inflation, monetary and price. Monetary price inflation has been happening in spades since the advent of QE in November of 2010 but most investors are not terribly concerned with hedging monetary inflation, just price inflation. Ultimately, monetary inflation can be deemed good but price inflation is most certainly not - the milliontillion dollar question is can one exist without the other?)

Over the next few months, the inflation figures the government will release will be much higher than they have been in quite some time. And these numbers will grab a lot of headlines. However, these numbers will be discounted by market pundits for a simple reason. The numbers are high because they are calculated on a year-over-year basis and it was exactly one year ago that the Covid pandemic brought our economy to our knees. And in the process, prices for many things fell precipitously. When calculating inflation, the government simply takes the current prices and divides them by prices from 12 months ago to figure out the rate of change. For example, say oil was $50 last March and now it is $60, then the rate of inflation would be 20% [(60-50)/50]. But if the price of oil was $30, then the rate of inflation on oil would be 100% [(60-30)/30]. So, they will argue that the only reason inflation is so high is because prices last year were so low. (Let the Spin Doctors spin away!!!)

I, and many of my clients, are not buying into the "fleeting inflation" story that will be pitched by the financial media and Wall Street. For those who are not in denial about the inevitable inflation surge, the next question is "how do we effectively hedge inflation?"

Gold is often promoted as the de facto means of hedging inflation. And I don't deny that gold will do well in an inflationary environment. But gold is not the best means of hedging inflation. The best means of hedging inflation is to invest in the things that create inflation. Things like wheat, sugar, oil, copper, etc. Gold for all its merits does not have any industrial use of note. If all the gold in all the world disappeared tonight, you and I could go about our daily lives without any fuss. But what if all the wheat or sugar or gasoline in all the world disappeared tonight...

A couple of weeks back, I did a study for some clients where I looked at the year-over-year difference in the price of various inflation plays. Here is a table of my findings:

| Security |

|

|

|

| USD |

|

|

|

| Gold |

|

|

|

| Silver |

|

|

|

| Platinum |

|

|

|

| Lumber |

|

|

|

| Crude Oil |

|

|

|

| Soybeans |

|

|

|

| Sugar |

|

|

|

| Wheat |

|

|

|

The table clearly illustrates that, at least over the past 12 months, gold has hardly served as a decent inflation hedge. Quite frankly, I'm shocked that gold hasn't done better in this environment but it is not my job to decide how well gold will or won't do. My job is to figure out how to find the best exposure I can for my clients given their investment objectives. Thus far gold has not been the answer to inflation. And fortunately, our inflation exposure has been far broader than just gold. We have owned agricultural products like corn, soybeans and wheat along with other commodities like oil and uranium (We have not owned lumber as it is a difficult commodity to buy but we have owned all the others.)

The advantage to investing in consumable commodities rather than gold is they are subject to real-life supply and demand. The price of gold is simply a product of market sentiment. And how can one accurately predict the sentiment of market participants? But as we have seen with lumber, a shortage of a commodity can lead to explosive gains that are many multiples higher than other securities. Thus, the best way to hedge inflation is to figure out where demand is going to outpace supply and cause shortages.

One area we are watching closely is soybeans and the other grains. The USDA came out with a report recently that suggests there may be a potential shortage in soybeans. There is commentary on the USDA website, or at least there was, saying that if the soybean growers in the Southern Hemisphere have anything less than a bumper crop of beans, the potential of shortages could be high. Can you imagine the price of beans or any other foodstuff if there are shortages? Will gold go up if there are shortages of beans or wheat? Absolutely. But will it gold go up as much as beans and wheat? Absolutely not!

Another component to factor in is a continued decline in the USD relative to the currency of our trading partners. Obviously, a depreciating local currency will lead to price inflation. And obviously, gold will do well in this environment. But wouldn't sugar and coffee and other commodities that the US largely imports fare better?

We are steadfast in the inflation camp, however, we are not sold on using gold as our primary inflation hedge. I believe that an investor's inflation exposure needs to be diversified just as one would diversify his or her equity or bond exposure. And for this reason, we use a myriad of securities to create a more effective inflation hedge. Furthermore, we understand that many inflation hedges only appreciate in fits and starts but can go a long time without any appreciable gains. And thus, we use our proprietary technical analysis tools to adjust our exposure on a continuous basis.