Performance Report: 05/31/2023

All performance data for our strategies is net of all fees and expenses. All performance data for indexes or other securities is from sources we believe to be reliable. All data is as of 05/31/2023.

Investment Strategy

MAP: Full ($500k+)

MAP: Mini

MAP: ETP (<150k)

S&P 500 Index2

Balanced (AOM)2

Global Balanced2

May Return

(3.6%)

(4.1%)

(3.3%)

0.3%

(0.7%)

(0.7%)

YTD

(1.1%)

(4.1%)

(3.3%)

8.9%

4.9%

5.1%

Inception1

27.6%

23.4%

19.5%

41.9%

12.3%

19.6%

VORR3

.656

.580

.469

.436

.224

NA

May was a setback for us. Going into this year, I was fearful that we would experience a period of underperformance. I wasn't looking forward to it and I've tried to protect your accounts from it but it finally hit us this month. I loathe exposing my clients through a spell such as this, but I knew it was a possibility. My thesis is simply that the paper markets controlling hard asset prices have been manipulated for over a decade and, at some point this year, the current system will break. And when it breaks, which inevitably it will at some point, we should enjoy sizeable profits. But until it breaks, we should expect a bumpy ride. I apologize for the added stress you have had to endure, but nothing has happened in the past few months to alter my view of what will take place. (I just want to add, that as of the writing of this update, my strategy has recovered the majority of May's losses in just the first 5 trading days of June.)

This past month, I came across three additional pieces of analysis that compel me to stay the course:

#1: John Hussman Ph. D. Reiterates My Thesis:

The following comments were made by John Hussman, Ph. D. in his May update:

The greater the misalignment between financial quantities and economic quantities, the more distorted and grotesque the whole picture becomes, particularly if nobody carefully connects the dots. Unfortunately, investors and policy makers repeatedly insist on learning that the hard way.

Once unsystematic policy causes a misalignment of financial quantities and real economic quantities, how are they realigned? It’s not a surprise: inflation, bond losses, bank failures, pension crises, stock market collapse, debt default, dismal long-term returns. Too much money chasing too few goods. Too much market capitalization with too few cash flows to service it. One way or another, the two are brought back into alignment.

Why? Because the economic quantities can’t properly service the bloated and misaligned financial quantities. It happens every time. It’s happened throughout financial history. This shouldn’t be so hard to understand. After more than a decade of deranged policy, the idea that more of these outcomes lie ahead shouldn’t be surprising.

Dr. Hussman is saying precisely the same thing as I am, except he uses the terms "economic" and "financial" whereas I used the terms "physical" and "paper". I use the latter simply because my background is in futures where "paper and physical" are part of the common vernacular. Dr. Hussman has a Ph. D. in economics from Stanford so he uses the terms associated with the world of economics. Regardless of word choice, the message is identical. Eventually, the economic or physical market overwhelms the financial or paper market. And when it does, it is never pretty for those invested on the side of the financial institutions.

With that said the financial institutions have been running this scheme for over a decade. And prior to that, they tried the same feat in the housing market. Eventually, the physical market or economic quantities will overcome but I can't put a timeframe on it. To expect their scheme to break all of a sudden right when I expect it to would be unrealistic. I have to build our exposure early to make sure we participate. Unfortunately, that resulted in a difficult setback in May.

#2: Middle Eastern Powers Disapprove of Wall Street's Oil Manipulation:

Next up are some telling quotes that appeared in an article on Reuters.com in May titled, "Saudi warns speculators of more pain as OPEC+ meeting looms":

Saudi Arabia's Energy Minister Prince Abdulaziz bin Salman said on Tuesday that he would inflict more pain onthe short sellers and told them to watch out just days before a planned OPEC+ meeting to decide on future oil policy. "Speculators, like in any market they are there to stay, I keep advising them that they will be ouching, they did ouch in April, I don't have to show my cards I'm not a poker player...but I would just tell them to watch out," he told the Qatar Economic Forum.

The Prince is essentially telling the "speculators" (read: Wall Street banks) that he is fully aware they are manipulating the market for his product and he is fully prepared to take action. Remarkably, the most powerful man in the world of energy has overtly told Wall Street he is coming for them and Wall Street has yet to flinch. Crude oil prices are down 14% since the last OPEC+ production cut and they fell more than 5% after he made these statements.

To support the Prince's views, the article continues by quoting analysts at Standard Charter bank who state, "that the speculative short positions in [crude oil] are now as bearish as they were at the start of the pandemic in 2020." Which begs the question, wy would speculators be as bearish today when the economy is moving forward at a respectable rate versus 2020 when the world's economy came to a literal stand-still? Obviously, the supply/demand equilibrium price is higher in today's economy than in early 2020. The answer is simply the speculators are seeking to carry out the FED's public policy rather than positioning themselves for profit. The FED's policy is to control inflation by all means necessary which includes having banks short the oil market even when they have absolutely no means of delivering on their shorts.

Will OPEC+ break the paper/financial market for oil? If so, how would they accomplish it? Thus far, production cuts didn't scare off the shorts. Will OPEC+ engage in some other means of influencing the oil market?

The Prince continued with a blame-shifting tactic making a fairly inflammatory claim against the Western world's largest energy policy group, the International Energy Agency (IEA).

Look who did the most in trying to bring forecasts and data projections that really created most of the volatility that we have had in 2022 and continue to do so? There is an organization called the IEA, I think they have proven that it really takes special talent to be consistently wrong.

Is this "shot-across-the-bow" a precursor to colder relations between the West and the Middle East? Saudi has already distanced itself from our nation's current Administration. Could they continue to grow more distant and ultimately threaten the Petrodollar?

#3: Russia Maybe "Quiet-quitting" Black Sea Grain Deal:

The third element in support of my thesis comes from analysts at Interactive Brokers who are making a bold call that Russia is "quiet-quitting" the Black Sea Grain Deal between them and Ukraine which was brokered by Turkey. The following quotes are from an IB-sponsored podcast titled, "Eyepopping Corn Prices - Fueling Food Inflation" (These quotes are directly from a podcast so they are in a conversational tone and not edited for grammar):

Similar to wheat, Russia and Ukraine also export a significant amount of corn supplies to the world. And that’s going to be wrapped-up in that Black Sea Grain Deals that we’ve talked about. They do end up being extended in March, but only for 60 days, as opposed to the 120-day extension that Ukraine and other partners in the agreement were seeking. That sort of lines up with our expectation that Russia is like quiet quitting on the deal, as you might say. That is, they’re not leaving outright, at least not yet, but also not fully holding up their end of the bargain. And that looming uncertainty around the deal, which seems pretty tenuous at this point, is going to create risk in wheat and corn markets going forward.

The following is another quote from the same podcast, which I find noteworthy:

I follow the Producer Price Index (PPI), and I discovered one recently that was kind of interesting when I heard that we’re going to be doing this topic, and it’s a series specifically for corn sweeteners. And, so, that’s going to be anything corn syrup, sugar, oil … anything produced from wet milling of corn. That index showed a year-over-year increase of 27.4% in February, and that was almost a 29-year high.

Let's do a little extrapolation on his comments. Yes, corn sweeteners increased in price 27% for the 12 months ending in February of 2023; however, during this same period, the spot price for corn fell over 13%! This kind of price dispersion just shouldn't exist. It would be akin to gasoline prices going up 27% while crude oil prices going down 13%. Or gold jewelry going up 27% while spot gold declined 13%. Items that are strongly correlated don't diverge in any significant way over any significant amount of time. However, because futures do not exist for corn sweeteners, the "two-headed fiscal monster" can't overtly manipulate their price. All they can do is manipulate the futures for corn.

The Tail is Wagging the Dog:

I want to wrap-up this portion with a quote from Michael Lewis' book The Big Short . (For those who may be unfamiliar with the book, it covers the story of three separate funds that bet big against the housing market in 2008 and, in the process, generated profits many multiples of what most investors would make in an entire lifetime.)

Cornwall Capital couldn't help but notice that Bear Stearns was not so much shaping the subprime mortgage bond business as being reshaped by it.

Cornwall Capital was the "garage-band hedge fund" that managed to grow their fund several multiples by worming their way into the institutional credit default swap market. Bear Stearns was one of the earlier and most significant participants in the subprime mortgage business but by the time the housing market collapsed, the name of any Wall Street firm could have been exchanged for Bear Stearns and the quote would read the same. Ultimately, all of Wall Street was seeking to shape the subprime mortgage business but, eventually, the subprime mortgage business shaped Wall Street...and consequently the US economy. The housing bust was a powerful and acute reminder that the physical market always overcomes the paper, the economic quantity always overpowers the financial quantity.

Every single Wall Street firm was on the same bullish side of the subprime mortgage trade. The FED was overly accommodating to Wall Streets' positions in the mortgage business. US public policy supported the mortgage market in every possible way as both sides sought to buy votes from Americans seeking to achieve the American Dream of home ownership. Despite every single financial and political force being in favor of housing and mortgages, housing and mortgages crashed because the economic law of supply and demand cannot be evaded in perpetuity.

The same will happen in real assets. The law of supply and demand cannot be evaded in perpetuity, it is just a question of when.

Market Update

The stock market continued higher in May, albeit at a slower pace. The bond market continued lower in May, albeit at an accelerated pace. Market breadth and leadership are about as dire as I've seen it. According to Churchhill Management, the gains in the cap-weighted indexes have been a result of just a few names.

Stock returns have been narrowly focused year-to-date. Large-cap Tech has carried the market with eight Mega cap stocks making up 6.44% of the 7.65% gain the the S&P 500 year-to-date.

While the Large-cap S&P 500 has appreciated nicely this year, smaller-cap indexes, which tend to lead the markets, have underperformed. Small-caps (IWM) are flat this year registering a 0.03% YTD return. The S&P 400 Midcap index (IJH) is down slightly for the year clocking in a negative 0.29% return. And the ever-important financial sector continues to lag by a remarkable margin. KRE which tracks regional banks is down 33.1% while IYF which tracks all large-cap financial stocks is down 6.5%.

From a technical standpoint, there is very little to like about the stock market. However, inflation seems to be tapering off providing the FED with the green light to return to its accommodating ways (I'm not so sure they ever really stopped being accommodating.)

For years, the stock market benefited from the TINA effect - There Is No Alternative. Last year, an alternative came roaring to the forefront in the form of short-term US Treasuries. And this resulted in liquidity leaving stocks for the safety of US Treasuries. But that trade may be played out. On the short end of the interest rate curve, rates have been largely steady for the past few months. On the long end, rates have become more attractive recently but I don't know who is going to chase a 3.5% return on a 10-year Treasury when 5.0% is available on the short-end? As long as inflation is trending down, the FED can continue to print which means stocks can continue to march higher. With that said, market bread and leadership attest to an incredibly low level of bullish conviction. The retail investor may still be pushing prices higher in big names but by all appearances, the big boys are exiting stage left.

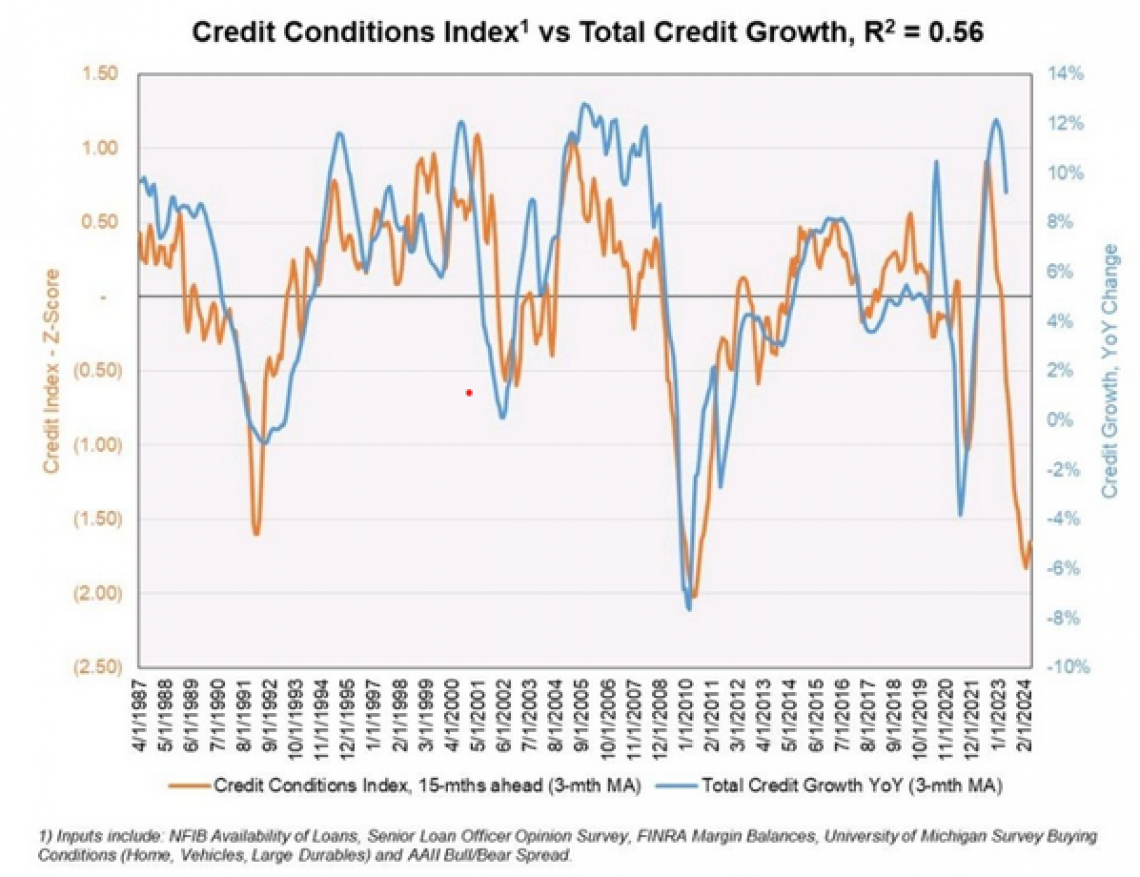

To wrap up this section, I am going to provide the following chart of "Credit Conditions" which shows credit drying up at a rate comparable to late 2008.

In a vacuum, this chart is pretty scary. But at this moment, it should be viewed in the context of current events. As regional banks imploded in March, credit evaporated. If the FED can solve the problems with regional banks and they start lending again, then a sharp correction of the "orange line" could be in store. However, if the regional banks fail to start lending again and nothing else fills the void, then it could provide a strong headwind for our economy. Our nation is heavily addicted to debt, and without it, it will be difficult for the economy to not avoid a severe contraction.

Given this chart, it's critical to keep a close eye on the financial stocks (IYF), specifically the regional banks (KRE). In addition to the abysmal performance of the regional banks, there are a host of life insurance companies that just got hammered earlier in the year and have made no attempt to recover. Insurance companies overall are not doing as poorly, just the life insurance-specific names. (LNC, MET & PRU are the ones I'm watching). These companies have massive exposure to the capital markets and if they have to start liquidating positions, it could really put a squeeze on equities, bonds and real estate. So if you're playing along at home, watch all these tickers I just mentioned.

Conclusion

Again, I hate to see short-term losses take place and I apologize for the added stress and discomfort you have to endure during this stretch. As I stated above, we have already recovered the majority of losses from May. While I'm growing impatient, I'm also growing more confident. I would be more than happy to discuss off-line some things that I'm seeing that make my position on the hard asset space undisputed.

For whatever reason, our nation's most powerful financiers seem bent on repeating the same mistakes over and over again. Today, they have come to hold the belief that price inflation for tangible goods can be perpetually contained via the manipulation of intangible financial instruments. I imagine there is not a single member of Wall Street who knows how to drill for a barrel of oil, grow an ear of corn, or mine for an ounce of aluminum. Despite this, their hubris allows them to believe these products are their own dominion.

Looking back at 2009, the world was asking why in the world financiers in New York City were allowed to write credit default swaps on real estate mortgages with no collateral and absolutely no means of being able to deliver on their guarantees. In 2007, this business model was widely accepted as just not prudent, but perfectly advisable. By 2009, the exact same exposure was deemed entirely asinine. In a few years, the world will be asking why a bunch of bankers in New York City were allowed to sell commodities that they had absolutely no ability to deliver.

We are, however, in unchartered territory. Prior to 2011, Wall Street had never been "net-short" the commodity space. Today, they are short the entire spectrum of commodities, even oil which underpins our nation's currency. As Dr. Hussman says, "One way or the other, the two [will be] brought back into alignment." When that happens, my hope for you is that I have the courage to participate in as much of the realignment as possible.

As always, please do not hesitate to call me at 512-553-5151 if I can be of assistance.

Best,

Matt McCracken

1) Inception date of 4/30/2019

2) All benchmark prices are obtained through the Yahoo!Finance website. S&P 500 Index is calculated using the index price. AOM is the iShares Core Moderate Allocation ETF. Global Balanced is calculated using a 40% allocation to the S&P 500, a 40% allocation to BND and a 20% allocation to IEFA.

3) VORR is our "Value over Risk Ratio": Calculated by taking the total return divided by the sum total of all negative months. Ideally, the ratio represents how much loss does an investor have to endure to get X gain. A negative RORR score implies there is more risk in the investment than return.