Performance Report: 04/30/2025

All performance data for our strategies is net of all fees and expenses. All performance data for indexes or other securities is from sources we believe to be reliable. All data is as of 04/30/2025.

Investment Strategy

MAP: Full ($500k+)

S&P 500 Index2

Balanced (AOM)2

Global Balanced2

Apr. Return

(2.0%)

(0.5%)

0.2%

(0.3%)

YTD

5.6%

(6.0%)

1.6%

(1.0%)

Inception1

56.8%

89.3%

32.6%

50.5%

Sortino3

0.83

0.68

0.38

0.60

(Disclosure: We need to compile additional data to report performance on all our strategies. Currently, we only have continuous data for our full-size MAP Strategy. In future months, we'll report on all our strategies. In the interim, know that the performance of your individual account may vary but should be correlated to our full-size MAP.)

Performance Update

Today marks the 6th anniversary of my proprietary MAP strategy and so far, so good. It began as a process of viewing markets based on liquidity flows and I’ve iterated on it over and over again. At this time, I really like where we are with it but I'm still working on a couple tweaks.

On a YTD basis and since inception basis, our performance is enviable. This year we are sitting on solid gains while broad stock markets are down a decent bit. Bonds are up modestly which is a bit surprising to many given how poorly stocks have performed. The most outstanding development in capital markets is the dire performance of the US$ which is down about 9% YTD. Not many people in my industry have experienced a stock market decline while the US$ has declined simultaneously.

(Note to Garrett's clients who are new to the Firm: Due to the substantial volatility in the stock markets, your individual returns are uneven and hard to report. Most of you are flat or down a little compared to the stock market which is way down. While you may not have fully participated in our YTD gains, your account likely outperformed our MAP strategy last year as I was early closing out my stock market positions in preparation for the decline this year. To see the returns on your account, you can go to the IB Portfolioanalyst tool and run a YTD or Since Inception report.)

On a YTD basis, most of our gains have been due to exposure to precious metals, which have outperformed by a wide margin the past couple of years. Throughout the 2022 bear market, the correlation between gold and the US stock market became unreasonably high, higher than it may have ever been since the end of the gold standard in 1971. Historically, gold is viewed as a safehaven asset, providing non-correlated returns versus cyclical equity markets. But that wasn’t the case for the first part of this decade. Now it seems the historically negative correlation between the two has been reestablished.

While the balance of our equity positions has been up, the one sector that has hurt us has been hard assets (i.e. commodities). This bewilders me, as I would think invoking tariffs would impact the price of hard assets—especially those we import—more directly than anything else. Our exposure to oil has been a drag on performance while our exposure to other hard assets like the grains has also been detrimental.

Market Commentary

Overall, I’m grateful to be where we are. At the same time, I have never been quite so unsure of how to position for the future. Looking at the markets, they seem about as bipolar as ever. At this juncture, I am not seeing any compelling reason to carry significant exposure to the stock market. There are a litany of indicators which suggest the odds of another decline are far higher than the odds of a meaningful rally. However, stocks tend to go up the majority of the time and I want to participate if there are any more upside surprises. First, I’ll cover the bear market case for equities. Here are the three most outstanding pieces of evidence that stocks should decline:

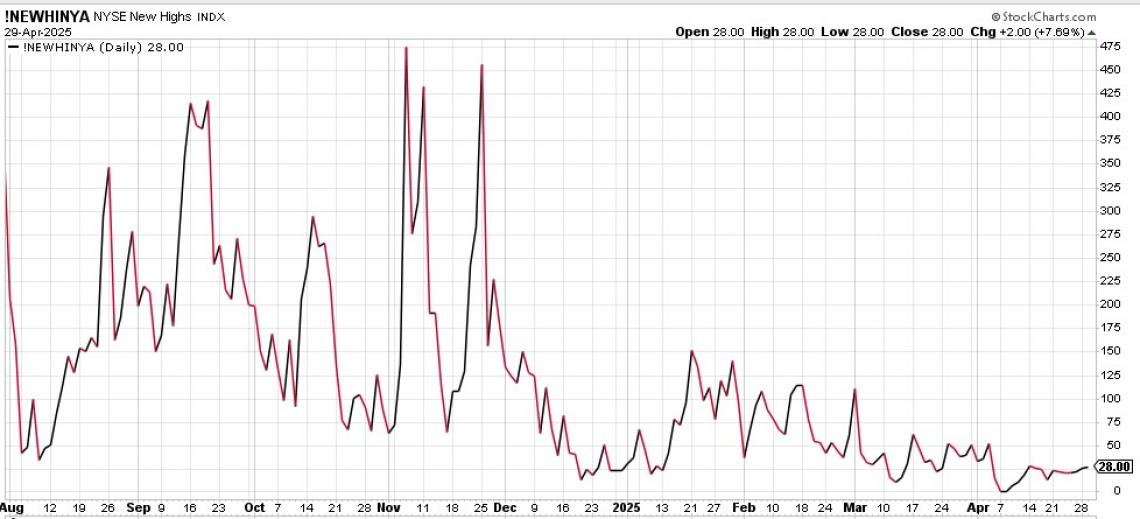

No Market Leadership

The following is a chart of new highs on the NYSE. Typically, when a bottom is in, a certain sector shows leadership and starts hitting 52-week highs even as indexes are stuck in the doldrums of a correction. However, even with the biggest one-day rally in stocks since the 1930s, coupled with a recent six consecutive day advance in the S&P 500, virtually no stocks are hitting new 52-week highs. I imagine the 28 stocks trading at 52-week highs are mostly mining stocks that are highly counter-cyclical.

After the 2022 bear market, there was leadership in AI, specifically the Magnificent 7. The post-covid rally was fueled by “work-from-home” plays and interest-sensitive securities. After the 2008 Financial Crisis, highly leveraged companies and dividend-paying stocks led the way higher. Currently, there are absolutely no signs of any leadership coming from any cyclical sector.

Volume

Volume is one of the best ways to measure liquidity flows (i.e. where money is going). While the stock market was being pounded in the early part of the month, volume was sky-high. But the subsequent rally the past couple of weeks has come on really weak volume. This means fewer and fewer investors are compelled to buy shares. If there was conviction behind this rally, volume should be stronger. I’ll need to wait to see how volume responds on down days to make a conclusive argument that volume is not supportive of higher equity prices, but as of now, volume is not painting a pretty picture. The spike in volume could have been driven by trading algos, in which case, it may not be as meaningful.

Technical Patterns

Over time, securities have shown a penchant for carving out “wedge patterns”. Patterns are studied by market technicians the world over. The “Head and Shoulders” is the one that gets the most notoriety. The “Death Cross” is another that makes its rounds in the financial media. Wedges aren’t covered as much but they occur regularly, however, they tend not to be as accurate of a predictor as a Head and Shoulders.

Currently, on the intra-day charts, both the S&P 500, the Dow Jones Index(DIA). and the NASDAQ 100 (QQQ) have carved out an obvious wedge pattern. These wedges have yet to be confirmed and it could be a while before they are. Here is a chart of DIA, the largest ETF tracking the Dow Jones Index:

For confirmation of the bearish wedge, the index would have to establish a lower high and then close below the most recent low. None of that has happened yet so this analysis is a bit premature but it is something to be watched.

If the wedges are confirmed, It may not be considered “gospel” like the Head and Shoulders, but a lot of people watch for these things and they have a way of becoming a self-fulfilling prophecy. This pattern coupled with collapsing volume suggests lower prices to come.

Now to the bullish argument for Equities

First and foremost, the path of least resistance for US equities has long been to go higher. Unless something truly bad happens, stocks appreciate. Let’s consider the past 15 years. Not once did the S&P 500 fall more than 10% from 2010 through 2019. Then in 2020, a global pandemic shut down the entire world’s economy. Yes, stocks declined due to the initial shock. But after the FED’s lightning-quick response to the tune of $5T in overnight stimulus, equities were off to the races yet again.

Then we have 2022. Inflation hits 9%, the highest reading since the late 1970s. Interest rates, which were at all-time lows, were forced higher by the bond vigilantes. Banks, which had absorbed a lot of that $5T in stimulus in 2020, had stuck their new-found cash in US Treasuries, which at the time yielded less than 1%. All of a sudden, yields are at 5% and practically every bank in the nation, save for a little community bank in Burnet, TX, saw their balance sheet turn massively upside down. Overnight, several decent-size banks collapsed. In 2008, it took Bear Stearns six months to collapse and Lehman held on for almost 9 months. Yet, in the chaotic environment we live in now, several regional banks collapsed overnight. But yet again, the FED rides to the rescue by allowing banks to virtually erase the negative equity on their balance sheets by giving them the privilege of valuing their bonds at par for the purpose of FED collateral.

Betting against the US equity markets has been a fool’s errand for quite some time. But with that said, a lot of unprecedented things have taken place this decade. The S&P 500 has experienced 3 declines of 20% or more just this decade. We have to go back to the 1930s to see a major stock index decline more than 20% on three different occasions in a single decade (Unless we go overseas to Japan which would have done it in the 1990s).

Then there has been inflation measured by CPI which clocked a 9% reading a little over a year ago. We have to go back more than a generation since that has happened. And a corollary to the inflation figure is interest rates which naturally go up when inflation is above trend. Not since the early 1980s have bond investors seen red on their statements simultaneously in both equities and bonds.

Some tariff noise is not nearly as bad as a worldwide pandemic, nor is it as scary as overnight bank collapses. So, the stock market should easily recover from this shock. However, if the US$ is losing its status as the world’s reserve currency, which could be exasperated by the tariffs, that is every bit as scary as the aforementioned issues. The US$ is the source of the FED’s power. And if it becomes weak, the FED becomes weak. And the US stock market cannot thrive if the FED is made substantially weaker. Make no mistake, the resiliency of the stock market is 100% dependent on the FED and its stimulus. Weak $ = weak FED. Weak FED = weak stock market.

So, “maybe it is different this time”. This phase is considered the most dangerous phrase in all of investing, which makes no sense to me. While Wall Street purports the “don’t worry, stay invested” mantra and that “it's never really different”, I believe it is always different. Wall Street pundits search high and low for “analogous periods of time” to extrapolate what may happen moving forward. The problem is no two timeframes have ever mirrored each other.

In 2010, no one could have predicted the straight-line returns that US equities would provide. In 2000, no one could have predicted that the majority of internet stocks would go bust and people would spend the next several years pumping money into hard assets over intangible ideas.

In 1990 no one could have guessed Japan’s market would crater and provide real negative returns for the next three decades. And in 1980, no one could have guessed that the little island of Japan would come close to owning the entire world in the span of 10 years. In 1970, no one could have guessed that the gold standard would collapse, and yet the US$ would maintain its status as the world’s reserve currency for at least the next 55 years.

My point is that everything, everywhere is in a constant state of flux. Financial Pundits say “it's never different” because they want zombie investors who do as they are told. They want us to go about quietly rearranging the deck chairs while they hop in the life rafts. But I won’t complicitly sit by waiting for things to return to normal. It's my job to figure out why things are different this time and adjust my approach accordingly.

One difference that some folks are starting to address is the idea that never before has one single person held so much sway over the capital markets. It has become quite obvious that our president can move markets with so much as a nod or a wink. This sentiment is starting to pervade my industry, but I’m not sure I agree with the idea that no other single person has held so much sway as President Trump does now. I believe several of the last FED Chairman (and woman) had the markets waiting on them with bated breath. The key difference is how these individuals operated.

Past FED chairmen and past presidents have been political people by nature. And, politicians naturally are consensus builders. That means discussing ideas with others and getting people’s input. Our current president seems to prefer to act unilaterally. Why is this important for us and the markets?

Let’s say a past president wants to do something like invading Iraq. Or a FED president wants to radically change the nature of currency markets by kicking off Quantitative Easing (QE). These actions would have been discussed with key team members. And as they are discussed, naturally, those with knowledge of sensitive information will share said sensitive information with their Goldman or Morgan broker. And that Goldman or Morgan broker shares it with his or her peers. And they start positioning their portfolios accordingly. First, they buy shares for themselves. Then they buy shares for their prop funds. Then once the news is announced they buy shares for their mutual funds or 401k funds, long after the low-hanging fruit has already been picked.

The stock market knew well before that the US was going to invade Iraq long before we invaded Iraq in March of 2003. The stock market knew well before the FED announced permanent QE in November of 2010 that the FED was going to engage in permanent QE. Nothing was all that surprising. And markets like that and responded accordingly.

However, when President Trump acts unilaterally, it doesn’t give time for Wall Street to build their positions. And if they are not out in front, then I don’t have a chance to see where the money is moving to. This creates a challenge for folks who do what I do. Trying to read the tea leaves and measuring the behavior of the markets is harder when one single person is pulling the strings.

A few years ago, even last year, if I saw the bearish technical case that is currently in front of us, I would pound my fist on the table and say, “Stocks are most likely going down.” But one whisper from Trump that tariffs will be rescinded or that a domestic stimulus package is on the way and, voila, stocks could make a substantial move higher.

The good news for us is that we can be more agile than most. If stocks continue to appreciate from here and the bearish wedge I illustrated is not valid, then there will be a whole lot of investors jumping back into the equity markets. Trust me, I’m not the only one looking at these types of things. There are teams of technical analysts in every Wall Street bank and on every trading desk at every hedge fund from San Fran to Greenwich, CT. We are all seeing the bearish case and we are all positioned accordingly. If we are proven wrong, it will be a mad dash to get repositioned. If we can be first, we will do well.

Conclusion

The sentiment I’ve heard from a lot of clients is, “I’m sure glad I’m not doing what you do.” Yes, it has been challenging, but I’m up for the challenge. I’m glad to be where I am because it’s always interesting and because I know if I’m diligent, objective, and proactive, the odds are we’ll come out on top.

I’m convicted in the knowledge that the capital markets will not get any easier moving forward. We are in a world that is becoming increasingly chaotic and fragmented. A lot of my peers are wishing for “the good old days”. My hope is that things will settle down, but my expectation is they won’t. I’ll continue to strive to stay ahead of trends while first protecting your hard-earned capital and continuing to grow it.

As always, please do not hesitate to call us at 512-553-5151 if we can be of assistance.

Best,

Matt McCracken

1) Inception date of 4/30/2019

2) All benchmark prices are obtained through the Yahoo!Finance website. S&P 500 Index is calculated using the index price. AOM is the iShares Core Moderate Allocation ETF. Global Balanced is calculated using a 40% allocation to the S&P 500, a 40% allocation to BND and a 20% allocation to IEFA.

3) The Sortino ratio is a commonly used measure of "alpha" or the value a manager adds to a portfolio. It is similar to the Sharpe ratio. The Sortino ratio does emphasize the negative impact of downside volatility more than the Sharpe ratio which is why we use it as our primary measure of alpha.