Performance Report: 06/30/2023

All performance data for our strategies is net of all fees and expenses. All performance data for indexes or other securities is from sources we believe to be reliable. All data is as of 06/30/2023.

Investment Strategy

MAP: Full ($500k+)

MAP: Mini

MAP: ETP (<150k)

S&P 500 Index2

Balanced (AOM)2

Global Balanced2

June Return

3.8%

4.2%

3.1%

6.5%

2.2%

3.0%

YTD

2.7%

1.4%

(0.3%)

15.9%

7.1%

8.0%

Inception1

32.5%

28.7%

23.1%

51.1%

14.7%

23.2%

VORR3

.780

.675

.531

.564

.322

NA

June was an excellent month for us putting us back in the black for the year. We are trailing both the S&P 500 and my benchmark for the year but still clocking better risk-adjusted gains than both since inception. Since the beginning of the stock and bond market correction last year, I have been able to protect your capital but have yet to grow it in a meaningful way the past 18 months. The MAP system has done a decent job of keeping us on the right side of the ledger until my thesis plays out. The stocks we've held have been largely isolated to the commodity space and have not done as well as the broad indexes buoyed by mega-cap tech names, but I felt as long as US equity markets were trending higher, they were worth holding.

As for my thesis, I'm always looking for additional data points to support our course. Here are a couple more I picked up this past month:

COMEX silver supplies reach a relative all-time low:

Running the numbers on the latest COMEX data shows the ratio of paper silver futures to silver available for delivery reached an all-time high this past quarter at 28:1. This means for every once of silver the COMEX has to deliver, there are 28 ounces of "paper" silver futures outstanding. Thus, if 4% of the outstanding contract holders demanded physical silver, it would exhaust the entire COMEX inventory.

The story is covered by the Schiff Gold website, which you can read by clicking here.

For as long as I can remember, gold bugs have been talking about the potential for "the mother of all short-squeezes" in the silver market. Their argument is based on the fact the paper silver market dwarfs the physical silver available; thus, if paper contract holders simply demanded physical, it would bankrupt the silver short-sellers because its impossible to deliver silver that doesn't exist. And yes, in theory, it could happen and anyone owning silver would see their positions explode higher.

But the gold bugs fail to explain that the silver contracts are spread out over 14+ expiration dates, so, the number of contracts expiring at any one time is not that much more than what the COMEX has to deliver. And given that no single party would own 100% of the contracts expiring in any given month, it is not likely that the COMEX supplies could be exhausted in a single month. Further, if the entire COMEX supply was liquidated in a single month, the COMEX would likely just change the rules to prohibit physical delivery in the future. So yes, it could happen but it's far more involved than what the gold bugs make it out to be. With that said, July and December are the big silver contract months so if someone were to make an attempt to bankrupt the silver shorts, it would likely take place in July or December.

However, for us, the news about the silver market has other ramifications. The fact that the paper market for silver dwarfs the physical by such an astounding ratio, could not the case be similar in other commodities? If "the two-headed fiscal monster" is proactively shorting silver, why not soybeans and sugar?

Silver and gold are unique commodities in that they are not consumed in any meaningful way. Most commodities like corn, sugar, and oil are readily consumed. It would require a Herculean effort to bankrupt speculative shorts in precious metals as centuries worth of production are being held in vaults, as well as shoeboxes, the world over. However, at any given time, the physical supply for ag commodities like corn is no more than 1 - 12 months. For oil, it may be 1 - 4 months. Industrial metals like copper and aluminum are easier to store so their inventory may be 6 - 9 months. While the short-squeeze possibility in silver is apparent, it would require several moving parts. But the short-squeeze possibility in commodities like corn or soybeans simply requires a brief shortage.

"The Reader's Digest version" of my thesis is there are a host of speculators in the futures market which are naked-short commodities that are consumed. Naked-short means they cannot possibly deliver the commodities they have sold-short. So, if a shortage situation develops, it will be impossible for them to cover their positions. If the buyer of a corn contract needs and expects corn and the short-seller cannot deliver, how many dollars would the contract holder demand in lieu of the corn he needs that is not available? The answer to that question is the potential short-squeeze opportunity. Yes, the "mother of all short-squeezes" could happen in silver, but I think it's more likely in other commodities. Which provides an ideal segue to my next point.

Corn futures suffer the second worst 7-day rout in the past 30 years:

The corn chart for the past month is nothing short of breathtaking. The following is the chart for the December expiration of corn:

As I mentioned in last month's update, Russia was quiet-quitting the Black Sea Grain deal. In the early part of June, Russia ended their silence and admitted they were quitting the Black Sea Grain deal. After they announced they would not renew the deal when it expires in mid-July, corn and all the other grains shot higher. Corn appreciated over 25% in less than two weeks as shorts got squeezed. But then the shorts doubled down and corn has now crashed over 25% in less than two weeks. Just in the span of June, corn's total volatility came in at 50% of its price. This is remarkable volatility for one of the most critical and largest commodities in the world.

On June 30th, the USDA came out with an acreage report that illustrated a shift away from soybeans into corn and wheat. And yes, that news, by itself, would be bearish for corn and wheat prices, yet bullish for soybeans. But there were a host of other updates that were not so bearish for corn prices. About half of the shift to corn was in Texas alone and I fear the hottest summer since 1980 in Texas will not be kind to crops. Another big piece of the shift was in Illinois (Texas, Illinois and North Dakota are the three largest corn producers.) Unfortunately, crop conditions in Illinois are currently very poor. Across the US, only 50% of corn crops are in excellent condition, the lowest since 1988. But in Illinois, only 15% are in excellent condition as Illinois received the least amount of rain on record in the critical month of June. (Source:

The last, and only, time corn fell so dramatically in the past 30 years was in the fall of 2008, during the worst financial market deleveraging since 1929. Everything with a dollar sign in front of it fell incredibly hard during this time, bank stocks were hardly the only victim. Oil and copper fell 75% in six months! Even gold dropped 30%. And grains were no exception. At the time, it was widely believed the US was falling into another prolonged depression like the 1930s as banks were seizing up. My point is, over the past two weeks, corn fell just as much as it did in 2008 and even more than it did in 2020 when Covid crippled the entire world economy. Both of these times were periods where market participants deemed the "sky to be falling". What prompted the June decline? A few more acres of corn being planted in drought-stricken states like Texas and Illinois? Massive short-selling may not be the only explanation for what happened to corn the past two weeks, but it certainly is the most likely.

With a little bit of good fortune and help from Mother Nature, US corn and wheat crops could come in at decent levels. And perhaps Russia reverses course and re-ups the Black Sea Grain deal which would certainly cause prices to go lower. But at this point, neither of these outcomes is a given. If US crops come in below trend due to weather and grains leaving the Black Sea are compromised by naval blockades, every single contract of corn sold by a speculator in the past two weeks will have to be covered at much higher prices. If there is not enough corn for delivery, corn prices would go sky-high resulting in a short-squeeze for the ages. Maybe it doesn't happen in corn or maybe it doesn't happen this year. But it's naive to think the world economy will never have commodity shortages again. When a shortage does rear its ugly head, for the first time in the history of the financial market, there will be naked-shorts with bets against the price of the commodity and with no earthly means of covering their positions.

Market Update

The stock market continued its ascent in June. While bond portfolios have not recovered their 2022 losses, equity markets have recovered a fair share of their losses. The iShares 20+ Year Treasury Bond Fund (TLT), the largest long-term treasury bond fund, is still 30% below its 2021 highs. However, the S&P 500 is just 8% below its all-time high. Stock markets experienced solid breadth in June with battered-down Small-caps and Financials leading markets higher. The technical picture for US equities improved quite a bit in June but there are still issues to be watched.

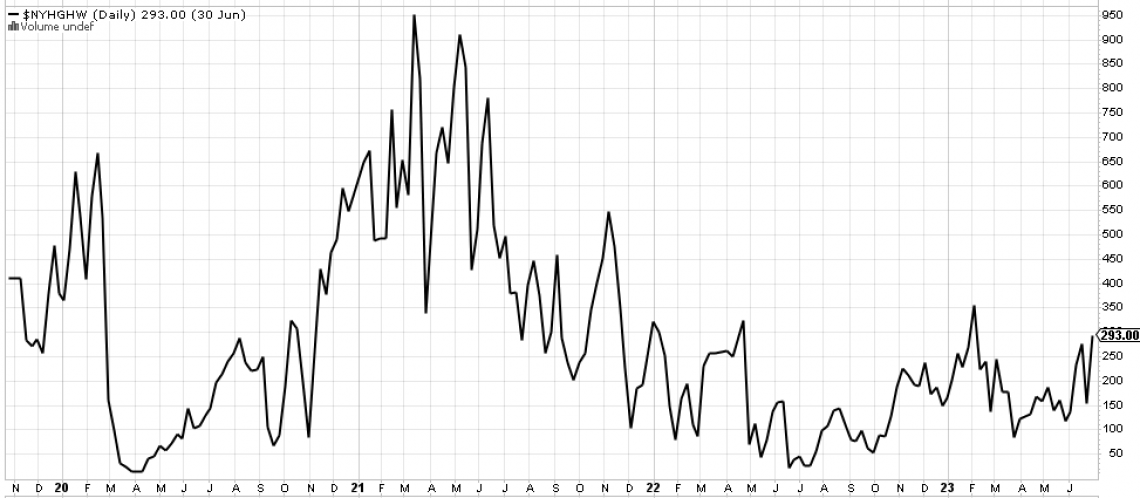

52-week highs for stocks traded on the NYSE are still very low given how strong the indexes have performed this year. In March of 2021, 52-week highs peaked at over 950. Subsequently, the stock market continued higher for nine months but the number of stocks hitting new highs saw a marked decline (see chart below). This means the number of stocks participating in the rally was continually diminishing. This type of divergence has defined the beginning of every single bear market since such statistics have been tracked. It's really quite remarkable how accurate this indicator is yet even more remarkable how few financial professionals pay attention to it.

A similar divergence is taking place now. In February, new highs hit 350, but in June, even with the S&P index 12% higher than in February, new highs failed to eclipse 300. But if we dive a little deeper, the dispersion appears a little more severe. In February, the S&P 500 was 9% lower than in February of 2022, meaning the index was not at a 52-week high, and thus not many stocks should be either. But currently, the S&P 500 is at a 52-week high, 17% higher than in June of 2022. So if the stock market was appreciating in a healthy manner, the number of new highs should be substantially higher now than they were in February, but as we see in this chart, that is clearly not the case.

As alluded to earlier, the moves in the stock market in June were healthier than in any of the preceding months this year. I'll continue to watch breadth and leadership to see if these stats continue to improve.

In addition, I am watching Financials (IYF/XLF/KRE) and junk bonds (HYG/JNK). Junk bonds have held up incredibly well given the developments across the rest of the capital markets. Currently, the largest junk bond ETF, HYG, is yielding just 5.73%. Who in their right mind is holding junk bonds yielding 5.73% when risk-free US Treasury bills are yielding over 5%? When things start to break, the cracks should show up in the Financials and in junk bonds first. There has been a major crack in the financials already which the FED has seemingly triaged. Junk bonds have yet to crack in any meaningful way though and if the US is headed to a recession, as so many are predicting, junk bonds should lead the way. That was not the case in 2022 because the 2022 bear market was simply a sector rotation phenomenon, not a precursor to a recession. We'll see what happens in 2023.

Conclusion

I am not sure if I'm ever really satisfied with my performance but given how the stock and bond markets have behaved the past 18 months, I am grateful for where we stand. I wish we would have participated more in the stock market this year but feel blessed that we have virtually avoided all the traps in the bond market. I am encouraged by my ability to get in and out of real assets. If my thesis is correct, then volatility in this space will increase and it will become more difficult to both participate and protect but I will remain diligent.

If the stock market starts to roll over, I'll likely move some of your assets from equities to short-term US Treasury bonds. Assuming these positions are held to maturity, it will negate some of the interest rate risk.

As always, please do not hesitate to call me at 512-553-5151 if I can be of assistance.

Best,

Matt McCracken

1) Inception date of 4/30/2019

2) All benchmark prices are obtained through the Yahoo!Finance website. S&P 500 Index is calculated using the index price. AOM is the iShares Core Moderate Allocation ETF. Global Balanced is calculated using a 40% allocation to the S&P 500, a 40% allocation to BND and a 20% allocation to IEFA.

3) VORR is our "Value over Risk Ratio": Calculated by taking the total return divided by the sum total of all negative months. Ideally, the ratio represents how much loss does an investor have to endure to get X gain. A negative RORR score implies there is more risk in the investment than return.